TRADE ALERT - Core Portfolio February 2026

Dear Landlords,

I want to extend a warm welcome to all our new members!

As a reminder, our most recent “Portfolio Review“ was shared with the members of High Yield Landlord on January 5th, 2026. You can read it by clicking here.

You can also access our three portfolios on Google Sheets:

New members can start researching positions marked as Strong Buy and Buy while considering the corresponding risk ratings.

============================

=============================

TRADE ALERT - Core Portfolio February 2026

Transaction:

I bought another 50 shares of Vail Resorts (MTN), increasing our position size by 50%.

-------------------------------------------------------------

Right now, there are lots of cyclical stocks that are taking a beating.

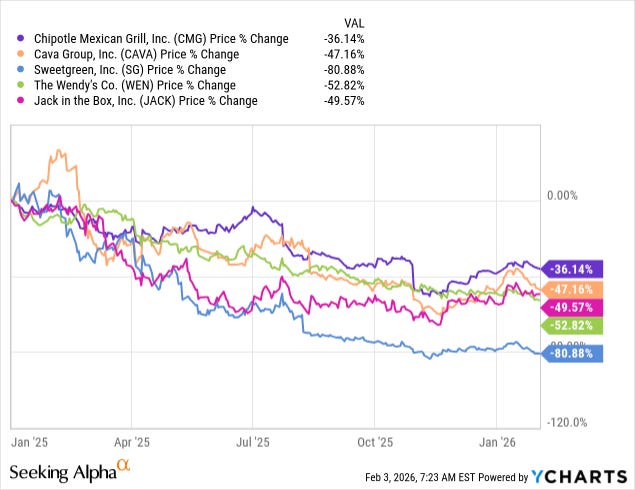

Restaurant companies like Chipotle (CMG), CAVA (CAVA), Sweet Green (SG), Wendy’s (WEN), and Jack in the Box (JACK) are down about 50% on average over the past year alone:

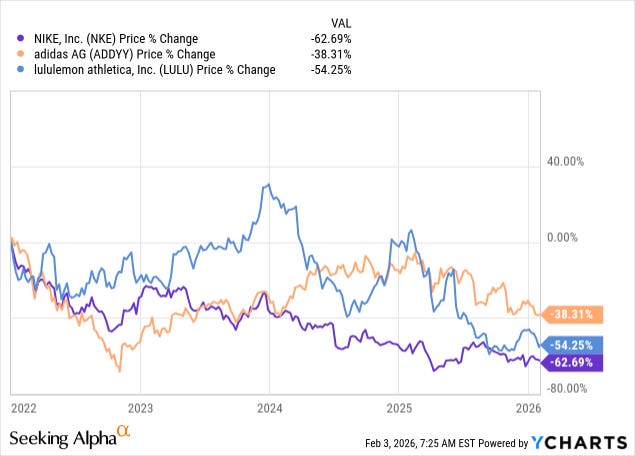

Apparel companies like Nike (NKE), Adidas (ADDYY), and Lululemon (LULU) have crashed just as much over the past few years:

So it should not come as a surprise that leisure, entertainment, and travel stocks are also suffering.

What they all have in common is that they rely on discretionary spending, even as the consumer and labor market are weakening.

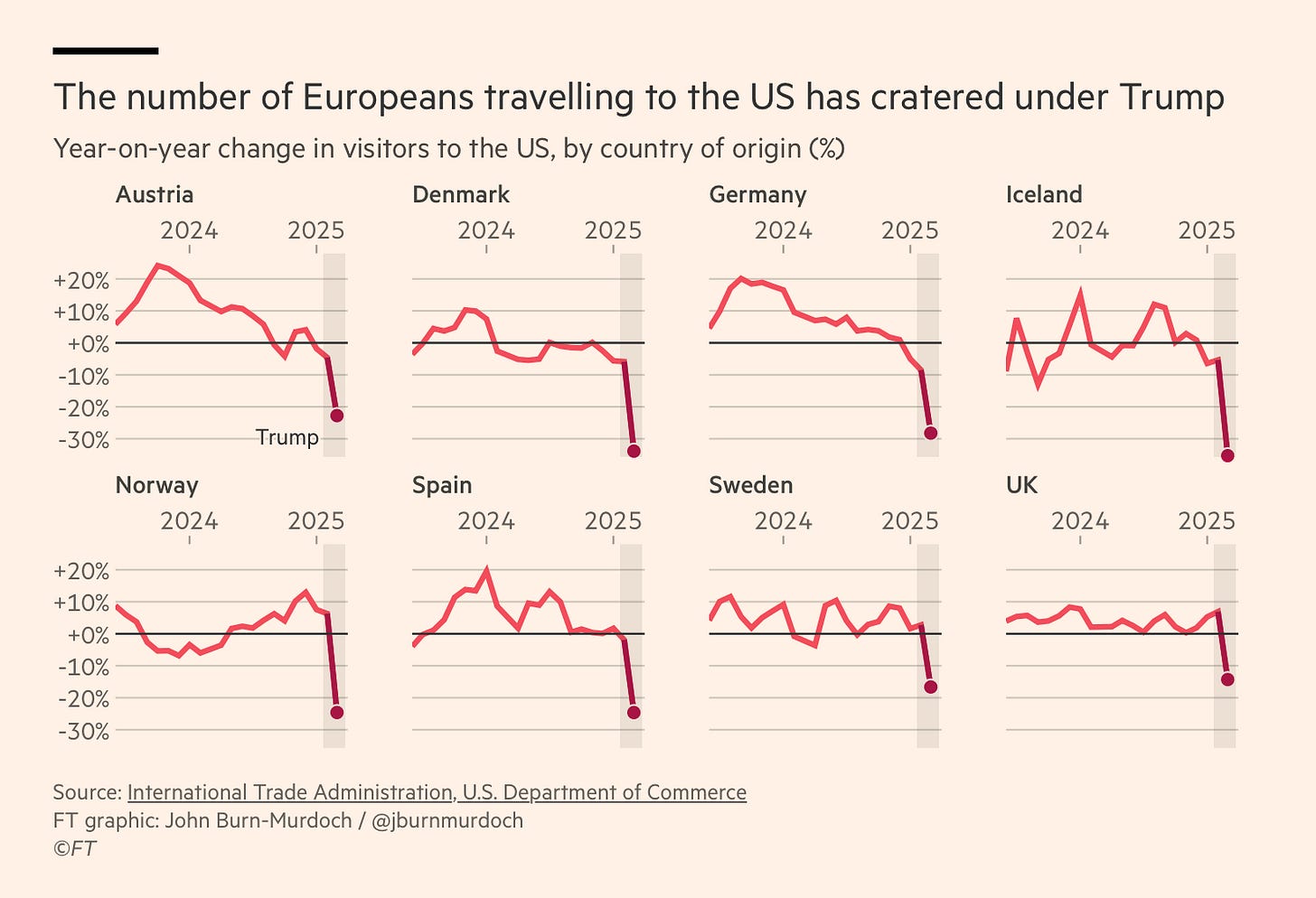

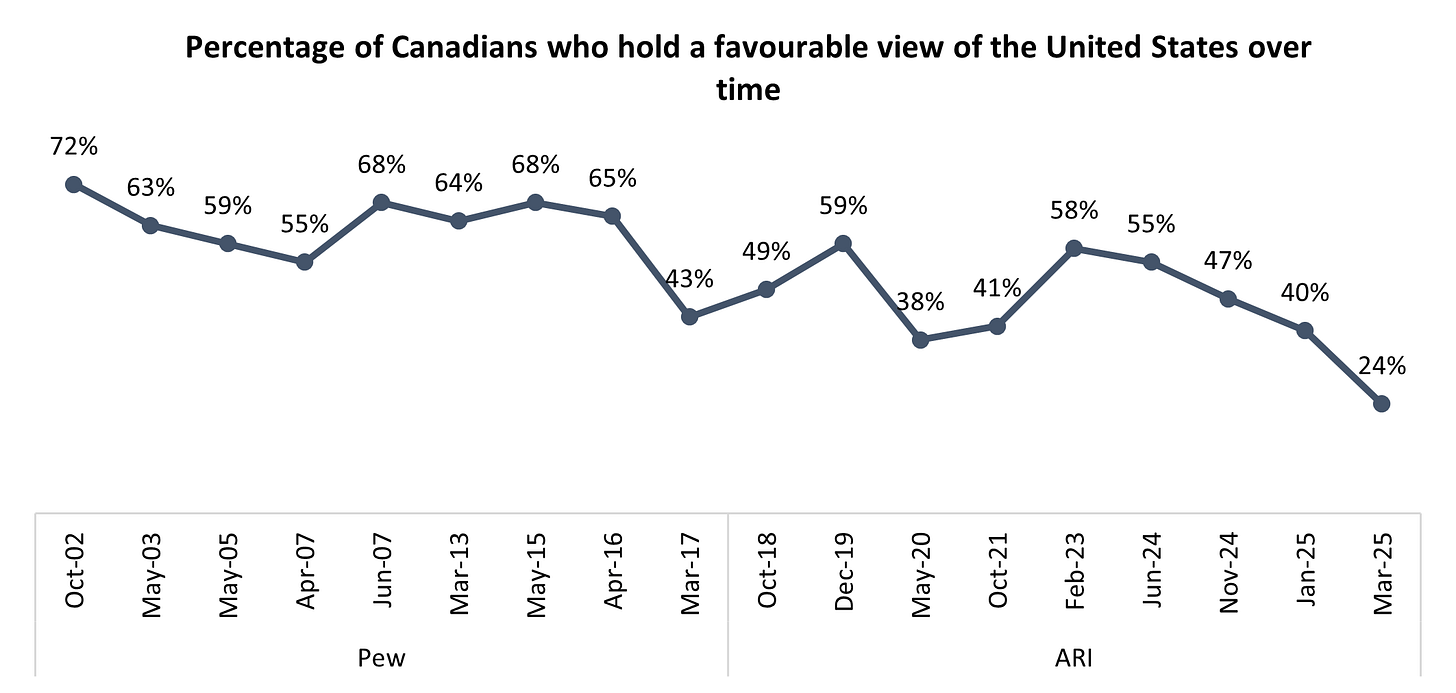

Travel and leisure companies are often suffering even more because they also rely on international tourists, many of whom are now boycotting trips to the US as a result of its current administration’s policies and rhetoric. This will likely only get worse before it gets better because of the recent threats to invade Greenland:

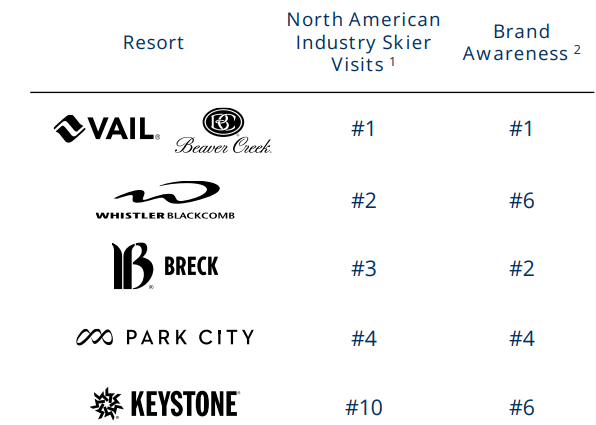

This brings me to Vail Resorts (MTN), which is the world’s biggest owner and operator of mountain resorts, owning over 40 resorts in North America, Australia, and Switzerland.

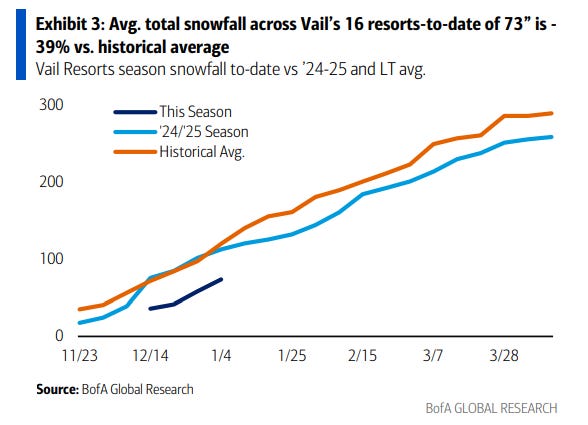

It was already suffering from the weakening consumer and the drop in international tourism, but then, on top of that, it is now also dealing with the worst snowfall in over 30 years in the Western US, where it has its biggest assets.

As a result, they could only open a fraction of the total terrain in December and January, and now expect their 2026 results to come below the low end of their guidance.

The market, of course, hates this, and this explains why its stock has dropped in recent months.

But we continue to think that this is a fantastic long-term opportunity and are happy to double down on the stock at these levels. We just bought another 50 shares for our Core Portfolio, expanding our position size by 50%:

We cannot know if this is the bottom yet, and admittedly, Q1 results are likely to disappoint, but it is not possible to time the market, and we will simply accumulate more shares if it keeps dipping.

Ignoring the short-term headwinds, the long-term thesis for these assets remains very compelling.

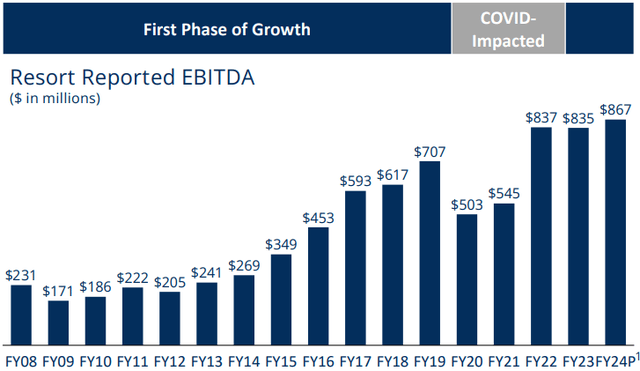

We are essentially buying a collection of irreplaceable assets with a monopoly-like business, benefiting from the growing affluent class and all the right secular tailwinds: experiences, social media posting, prestige, fun, and exercise. Not surprisingly, it enjoys extremely strong pricing power, and this has historically resulted in strong growth in profitability:

The company is also well-capitalized with a 3x debt-to-EBITDA and has a shareholder-friendly management that owns a lot of equity itself (the CEO alone owns $30+ million) and is now busy buying back shares.

Even then, the stock is now priced at just about 8x EV/EBITDA, 11x FCF, and a 6.8% dividend yield.

That’s exceptional for a business of this quality, in my opinion.

Yes, it is facing some near-term headwinds in a weakening consumer, a drop in international tourism, and poor snowfall. But even under these circumstances, it is still expected to earn only slightly less EBITDA this year than in 2025.

It is not good, but it is not catastrophic either. What makes it more resilient to weather concerns than the market appears to understand is that its portfolio is geographically diversified, and it now earns most of its revenue from season passes rather than lift tickets, which you must purchase before the season begins by early December. It is still impacted since poor snowfall will lead to lower traffic, which will then result in lower ancillary spending. Some people also decide to buy lift tickets rather than season passes.

But it is not as catastrophic as many media headlines make it seem.

The business is of such high quality that even when facing such severe headwinds, it is still able to roughly maintain its profitability.

Next year, I would expect there to be significant pent-up demand at these resorts, and I know this because I am a skier myself. I always go to the same spot, and when the snow is poor in one year, I will ski a lot more the next year. I imagine that there is a large number of other skiers who do the same.