Updates on our European Top Picks

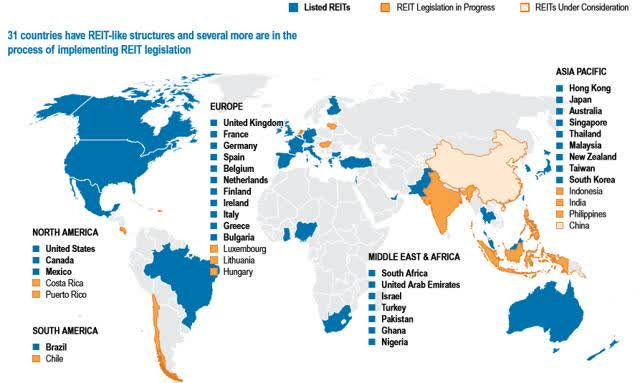

Something unique about High Yield Landlord is that we don't cover just US REITs, but we also cover foreign markets.

Today, over 30 countries have adopted the REIT regime, providing a lot of opportunities for us to evaluate:

Our International Portfolio is optional and intended for investors who want greater diversification to boost risk-adjusted returns.

Personally, I aim to invest at least 25% of my REIT portfolio in non-US markets. Some members may prefer to allocate a higher weight to international opportunities, while others may ignore them altogether. It comes down to your personal preferences, risk tolerance, and return objectives.

The goal here is to provide you with the information and tools needed so that you aren’t just limited to US markets. It will allow you to identify and research new investment opportunities in Canada, Europe, South America, Asia and even Africa from the comfort of your home.

The Portfolio currently holds 16 positions - out of which 8 invest in Europe, 5 in Canada, 2 in Asia/Pacific, and 1 in Africa:

In today's article, we give updates on our 8 European Top Picks:

KlePierre: French Mall REIT

Branicks: German Asset Manager

Vonovia: German Residential Company

Big Yellow Group: British Self-Storage REIT

Segro PLC: British Industrial REIT

Cromwell European REIT: Diversified Quasi-Industrial REIT

Cibus: Finnish and Swedish Essential Retail

Tallinna Sadam: Estonian Port and Land Holding Company

KlePierre (EPA:LI / OTCPK:KLPEF)

Class A malls are today doing very well.

We already know this about the American market as Simon Property Group (SPG) and Macerich (MAC) have both released strong results with their sales and rents per square foot reaching new all-time highs. This may seem surprising to those of you who don't follow the sector closely and constantly hear news about yet another mall closing down.

But note that we are talking here about Class A malls. Those are doing very well because:

When a low-quality mall closes down, it leads to traffic consolidation, benefiting the remaining higher-quality malls.

There has been close to no new supply of those high-quality malls for a long time now.

High-quality malls have evolved into mixed-use destinations with large service, entertainment, and other non-retail use components to draw traffic.

They are typically in exceptional locations with high population density and relatively wealthy households.

Finally, retail real estate is one of the best inflation hedges.

The same is true in Europe but to an even greater extent.

European malls are even healthier because of three key reasons:

There is far less supply of retail space per capita in Europe.

European malls are in even denser locations that are typically walkable, enjoy good access to public transport. For this same reason, they also enjoy far greater barriers to entry since these locations are generally already fully built out.

They are mostly anchored by big grocery stores, bringing steady daily traffic, instead of dying department stores.

This is well reflected in the results of KlePierre.

In 2022, they grew their FFO per share by 20%, and last year, they grew it by another 10.7%. The initial guidance was to grow by 5.2%, but they doubled that.

Their mall occupancy rate reached 96% (vs. ~93.5% for MAC in the US), their net rental income rose by 9%, and sales per square foot rose another 6%. This also allowed them to hike their dividend:

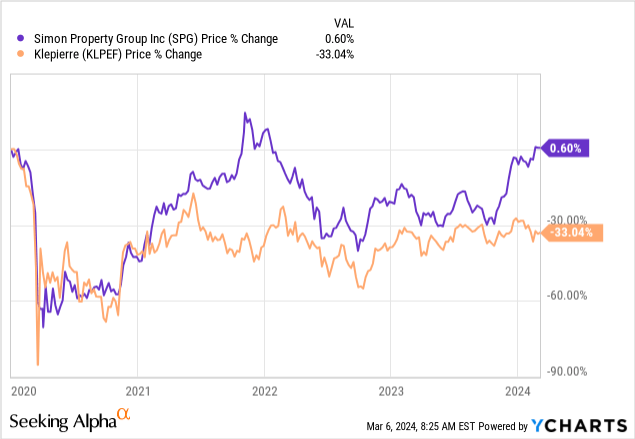

But the interesting thing is that this strong performance is not reflected in its share price.

Despite owning better properties on average, KlePierre has massively underperformed its US peers in this recent recovery and as a result, it has become more opportunistic, relatively speaking:

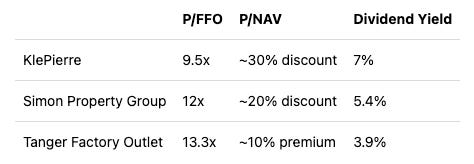

KlePierre is now also priced at a materially lower valuation:

(I would add that KlePierre's discount to NAV may be understated because it has sold assets at 20% above its appraised values, and the current appraisal cap rate is about 6%, which is high for class A malls in Europe)

What is causing this disparity in performance?

It is likely of one primary reason. Interest rates were even lower in Europe prior to this recent surge, balance sheets were more heavily leveraged, and as a result, European REITs were more heavily impacted.

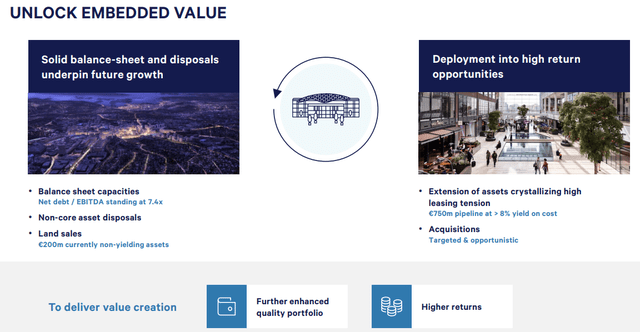

But the good news in the case of KlePierre is that it has a strong BBB+ rated balance sheet, a 38% LTV, and a 6.3-year average debt maturity. Its Debt to EBITDA is a bit higher than its US peers at 7.4x, but it will come down in the coming years as the REIT sells some non-core assets, including some non-yielding land, and reinvests that into higher-yielding development/redevelopment projects:

Moreover, long-term rates have already dropped substantially in Europe and interest rates are expected to be cut first in Europe. The market is today pricing a 75 basis point cut by the end of this year:

So yes, the surge in interest rates has a negative impact on KlePierre, but it is not as significant as the market makes it to be.

Even as it refinances some debt in 2024, the REIT is still expected to grow its FFO per share by 1-2%. Ignoring the impact of the rising interest expense, it would grow its FFO per share by 5-6% in 2024.

For this reason, I believe that KlePierre is opportunistic right now. I believe that it will catch up to its US peers as interest rates return to lower levels and the market sentiment of REITs improves.

If not, it would not surprise me if SPG made a move to buyout KlePierre. As a reminder, SPG is its biggest shareholder, owning 20%+ of the equity, and it could probably expand its FFO per share by quite a bit given that it trades at a higher multiple and could benefit from many synergies.

We are upgrading it to a Strong Buy rating.

You can read our investment thesis by clicking here.

Branicks

We recently shared an update on Branicks and you can read it by clicking here.

In short, we argued that Branicks had become very speculative and that it would likely either become a multi-bagger or face bankruptcy in the near term.

That's because its valuation is ultra-low, trading at just ~1/10 of its net asset value, but this is because the company was facing a liquidity crunch. It has valuable assets, solid cash flows, but it had major debt maturities coming later this year and had nowhere enough cash to handle those.

The situation was very risky, but we argued that the risk-to-reward was compelling for aggressive investors because we thought that lenders were likely to work with Branicks and grant it an extension to sell assets and repay its debt.

That's precisely what has happened.

Just recently, Branicks announced that it had managed to extend its promissory notes until the 30th of June 2025. It also repaid €40 million of its bridge loan and the remaining €160 million has been extended to to the 31st of December 2024 to give it some breathing room. Finally, it gained another €60 million of net proceeds by trading 8 properties to VIB, its industrial arm.

This has caused Branicks's share price to surge about 60% from its lowest point, but even then, it remains exceptionally cheap.

The big question now is whether they will manage to sell enough assets to repay their bridge loan at the end of 2024.

The management appears optimistic that they will and an independent review by an external consultant hired by the lenders believes so as well. Interest rates are expected to begin to drop in Europe in the coming months and this should lead to a recovery in transaction activity.

Here is what the management commented about this debt extension:

“Branicks now has a stable foundation for shaping the future of the company. We are pleased that we have the broad support of our creditors. The stabilization of the transaction market gives us additional confidence. We can build on this and now concentrate fully on the operational core of the company again, i.e. on generating value and improving efficiency by focusing the company on high-quality real estate in the office and logistics asset classes”, commented Sonja Wärntges, CEO of Branicks Group AG.

This is very encouraging. The probability of Branicks becoming a multi-bagger (instead of a 0) increased quite significantly following this deal, and perhaps more than what the market is giving it credit today. For this reason, I am considering making another small addition to our position.

You can read our last update by clicking here.

Vonovia (OTCPK:VONOY / VNA)

In our recent update on the residential sector, we explained that most apartment REITs in the US were dealing with oversupply and this was causing their rents to stagnate.

But this is not the case in Germany.

The German housing market is in a perpetual state of undersupply because of how its rents are regulated and as a result, Vonovia's vacancy rate is at a historic low of just ~2%, its rents grew by nearly 4% in 2023, and it expects another ~3.5% of growth this year.

That may not seem like much, but it adds up over time, especially when considering that Vonovia is leveraged.

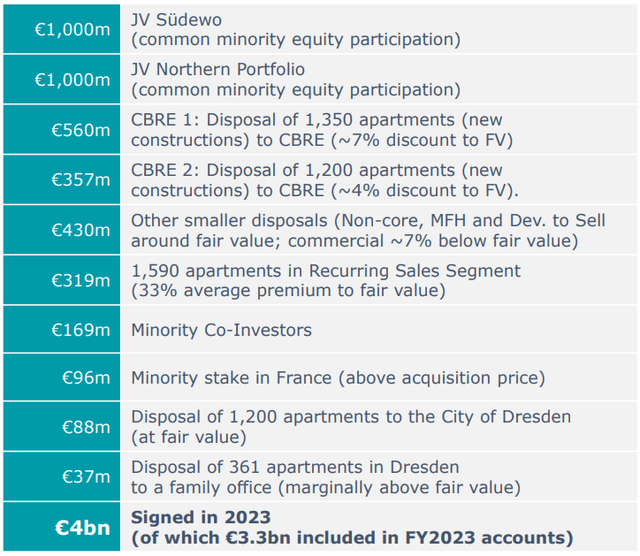

But the real big news is that Vonovia sold €4 billion worth of assets in 2023, which was 2x more than they had initially guided for, and they expect to sell another >$3 billion of assets in 2024 to pay off debt maturities and reduce leverage.

It significantly reduces the balance sheet risk since they now have their near-term debt maturities covered.

On the negative side, the NAV per share of the company dipped a bit further due to cap rate expansion and it is now at €46.82 per share. This means that the discount to NAV has been reduced to 45%, which is still significant, but not as large as its used to be. At the bottom, we were buying shares at a 70% discount!

The good news is that this NAV appears to now be stabilizing. The most recent sales occurred at prices that were in line with their NAV or even at a slight premium to it. As rates are likely cut later this year, this should limit any further slide in the NAV:

Another notable news is that the company announced a new dividend policy which will aim to pay 50% of their FCF plus some additional adjustment. This could lead to some volatility in the dividend payout and the initial reaction of most investors appears to have been negative to this, but it should provide Vonovia more flexibility as it returns to growth in the coming yeas.

You can read our investment thesis by clicking here.

Big Yellow Group (OTCPK:BYLOF / BYG)

We just recently bought more shares of Big Yellow Group and discussed its latest results.

In short, Big Yellow grew its FFO per share by another 7.6% in 2023, and this strong growth is set to continue in the coming years because the company has 11 new self-storage facilities currently under construction and this is set to expand its total capacity by 15-20%. On top of that, the company currently owns about the same amount of space that's still vacant and not producing any cash flow.

I think that these development projects, coupled with strong organic growth, should result in 8-12% annual FFO per share growth in the coming years.

That's one of the fastest growth rates in the REIT sector today, and yet, the company is heavily discounted, trading at a near 20% discount to its NAV, 16x FFO, and offers a near 5% dividend yield.

Historically, Big Yellow has generated ~15% average annual total returns to its shareholders, and we think that it is likely to achieve similar results for its shareholders going forward. That's very attractive coming from a defensive REIT like Big Yellow.

You can read our last Trade Alert discussing the company by clicking here.

Segro PLC (OTCPK:SEGXF / SGRO)

Segro PLC is our favorite industrial REIT in Europe. It is mainly invested in Class A urban properties in the UK, but it also has a growing portfolio in continental Europe, and it is growing an asset management business, managing industrial investments for others in exchange of fees.

We first invested in the company in October 2022 when its share price dipped to 733 British Pence per share. We argued that its valuation had dropped too low given that its rents were rising at a rapid pace, its balance sheet was in great shape, and the company had great external growth prospects.

Since then, the share price has been recovering nicely. It is up about 15% since our initial purchase and this is well justified when you consider its performance.

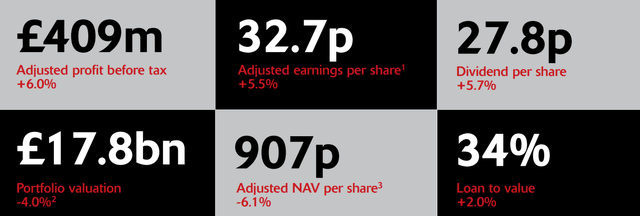

Even despite facing rapidly growing interest expenses, it was still able to grow its FFO per share by ~6% in 2023 thanks to strong releasing spreads on expiring leases. It also hiked its dividend by another ~6%.

I met the company's CEO last year at the Citi Global Property Conference and he also seemed very optimistic about the future. He reaffirmed that again on their most recent conference call.

But, there's one setback.

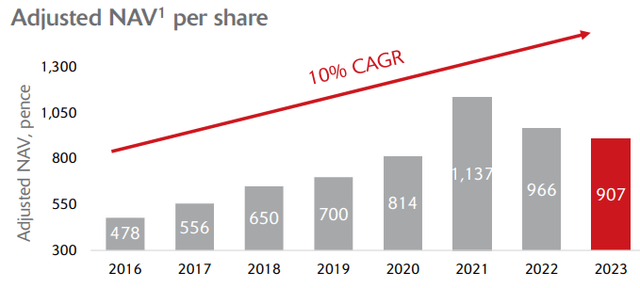

Their NAV was marked down again by its appraiser. The appraisal cap rate has now been increased by ~150 basis points and it is currently at 5.2%. As a result, the NAV of the company is down quite considerably since late 2021 and the current share price is just 7% shy of this NAV:

However, it is important to note that here this NAV is quite conservative.

The company's rents are today about 15% below markets and as interest rates are cut in the near term, we should see its NAV recover to higher levels. At its peak, it was at 1,137 British Pence per share and that's when the company's cash flow was significantly lower.

Last year, Blackstone (BX) acquired a British industrial REIT at near its net asset value, which suggests that they believe that valuations have upside from these reduced levels.

So while today's NAV may suggest that Segro is fully valued, I think that the NAV itself has some upside potential.

I would add that Segro has a lot of new properties (30+ of them!) under development and they are projected to reach a 7%+ initial yield, which would create significant value for shareholders.

Cibus (CIBUS)

Our Finnish/Swedish grocery real estate investment has nicely recovered over the past year with its share price rising by about 30%.

The company's operational performance has remained very strong because its rents are directly linked to the CPI. As a result, its rents have now increased by nearly 15% over the past two years.

It is hard to find a better inflation hedge than grocery stores with strong tenants and CPI-linked leases.

Moreover, the company managed to mitigate some of the market's concerns over its leverage by raising some new equity. It brought its LTV back towards the lower end of its target range of 55-65% and allowed it to buy back some bonds at a discount.

Even then, its leverage remains relatively high at 57% and this is the primary risk of the company in case interest rates keep on rising. However, it appears increasingly likely that interest rates will return to lower levels in the near term, and Cibus enjoys well-staggered maturities with a 5-year average term and growing rents.

Today, the discount to NAV is just 10%, which is quite a bit more expensive than the valuation of most other European REITs, and therefore, we don't give it a Strong Buy rating at this time. However, we still give it a Buy rating because we think that Cibus should benefit more from rate cuts than most other companies. We think that it will lead to a rapid increase in its NAV per share as they readjust their cap rate assumptions, and on top of that, we expect the discount to turn into a premium. Shortly before the crash, Cibus actually traded at a 50% premium to NAV.

While we wait, we also earn a 7%+ dividend yield and the company's rents will keep on rising.

Cromwell European REIT (CWBU)

Cromwell European REIT is a Singaporean REIT that invests only in Europe and it owns mainly industrial properties and office buildings, many of which are occupied by government agencies.

The interesting thing about CERT is that it yields a lot more than its European peers because Singaporean REITs typically choose to pay out 100% of their free cash flow to their shareholders in the form of dividends. That's the common dividend policy over there. Moreover, there is no withholding tax in Singapore and so that's another interesting advantage for income-driven investors. Some European countries like Germany charge 26% so this is a unique advantage of investing in European real estate via Cromwell European REIT.

This lack of withholding tax on the dividend is especially attractive considering that the REIT is offering a high ~11% dividend yield.

The yield is so high because the company is priced at a 33% discount to its net asset value and just 9x FFO.

That's a particularly low valuation for a REIT that owns primarily industrial assets (53%as of right now) and an investment grade rated balance sheet with a relatively low 38% LTV.

Why is it so cheap then?

Two main reasons.

Firstly, the company unfortunately has a relatively short average debt maturity of just 2.5 years and this explains why its cash flow dropped by 4% last year, despite enjoying a 5.7% releasing spread on its renewals and new leases. If rates remain high, its cash flow will likely drop again as it refinances its 2025 maturities. Fortunately, it has nothing maturing before November 2025, leaving it some time for rate cuts to take places and for its rents to grow further.

Secondly, while the REIT owns mostly industrial assets, it still generates 45% of its revenue from office buildings and the market does not seem to like that.

However, it is important to note that the European office market is performing far better than in the US. To give you an example, Dutch prime office rents have risen ~30% since COVID-19 (about half of its offices are in the Netherlands). This is also well reflected in property values as the company has sold €200+ million worth of assets in the past 2 years at a 15% premium to their appraised NAVs.

The REIT plans to keep lowering its exposure to offices and has another €200+ million of planned asset sales. The management believes that this will allow them to reach a higher valuation as they reduce their exposure to office properties and keep increasing their exposure to industrial assets, eventually becoming a quasi-industrial REIT.

The nice thing here is that the management owns ~€400 million worth of shares, representing 28% of the equity, and therefore, they are truly motivated to unlock value for themselves and other shareholders.

While we wait, we earn an 11% dividend yield, which will likely fluctuate a bit but should remain high in the coming years.

Tallinna Sadam (TSM1T)

Tallinna Sadam is our investment in Estonian real estate. As we have explained in a previous article, we believe that Estonia is set to become one of the wealthiest countries in the world, and with that, we expect real estate prices to grow significantly over the coming decades in its capital city, Tallinn.

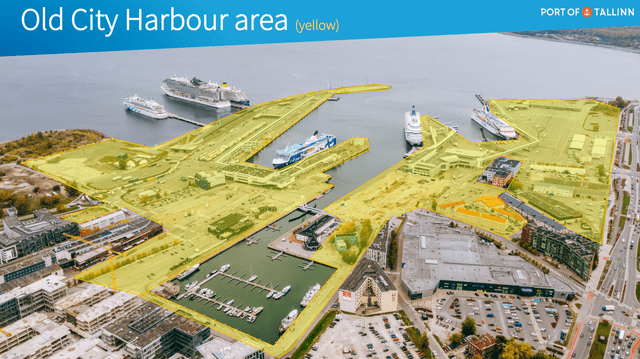

When we initiated our position, we thought that Tallinna Sadam was one of the best public vehicles to participate in this opportunity. It is the owner of the main Port in Tallinn, a few other ports in Estonia, a small ferry business, and importantly, it owns lots of valuable land surrounding its Port in Tallinn.

But unfortunately for the company, it suffered three major black swans in the past few years.

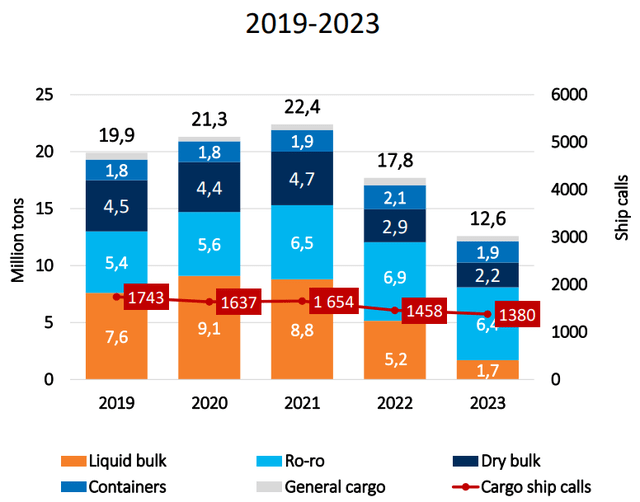

The first one was the pandemic. It disrupted the passenger business of its port and to this day it hasn't fully recovered, likely because the restrictions stayed in place for so long that people changed their usual travel routines. As an example, instead of traveling from Helsinki to Tallinn over the weekend, Finns began to travel much more within Finland:

The management thinks that the recovery will continue in 2024, but the passenger volume of its port business likely won't reach its pre-COVID levels before another few years.

The second black swan was russia's invasion of Ukraine and the resulting sanctions, which then caused a major drop in Tallinna Sadam's cargo business as you can see below:

This cargo is not coming back any time soon so the value of this business has also been impaired.

The third bad news is that the historic surge in interest rates put most new development projects on halt and this explains why there has not been much progress in terms of monetizing Tallinna Sadam's large land holdings:

That's all the bad news.

Risk factors have played out and it justifies a lower valuation for Tallinna Sadam's business in the near term.

However, if you look 5-10 years out, the real estate aspect of the thesis remains perfectly valid, and the port business should also eventually recover.

The passenger volume continues to rise steadily towards pre-COVID levels, and eventually the cargo that once came from Russia/Belarus will likely at least in part be rerouted to other sources.

Moreover, its land holdings have kept gaining significant value over the past few years. There are fewer transactions happening in the apartment market today, but the sales prices are happening at far higher prices per square meter than they did two years ago. Just to give you an example, when I bought my condo, which is located on a seafront site very close to the land of Tallinna Sadam, I paid about €4k per square meter. Today, similar apartments are selling at closer to €7-8k per square meter and this is just three years later.

A major part of this orange land below will be residential real estate:

This land today isn't generating any cash flow and the market isn't giving it much value. However, if you buy into the thesis that Estonia is set to become one of the richest countries on earth, then the delay in the monetization is not necessarily bad news. The thesis will take longer to play out, but the eventual payout could be greater down the line.

The dividend will help us to stay patient in the meantime. With the current payout, the yield is about 6%. We reaffirm our Buy rating.

Closing Note

We remain bullish on all of these names.

Our Top Pick out of these names is KlePierre for the more conservative investors. It keeps performing remarkably well but its share price has significantly underperformed its American peers in the recent past.

More aggressive investors may also consider Branicks which could very well become a multi-baggers in the coming years and this is why we have bought a bit more of it, but keep in mind that it remains very speculative despite the recent good news.

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.

Seems like The Cromwell European REIT is no longer existing

"Cromwell has agreed to sell its European fund management platform and interests, including the Cromwell Italy Urban Logistics Fund and Cromwell European REIT, to Stoneweg for €280 million"

soure: https://www.cromwellpropertygroup.com/cromwell-sells-european-fund-management-platform/

Any updates on this?

BTW which broker do you use for this stock?