What Austin Bought And Sold In August 2025

This is the next installment in our monthly series on the portfolio of our macro analyst, Austin Rogers. Please note that our main focus will remain on the HYL Portfolios, but since many of you have expressed interest in knowing how Austin manages his portfolio, we are posting this to give you extra value.

There are lots of important macro trends that are converging right now and making the future hazier than ever.

That makes the task of investing quite difficult. To be an investor is basically to be an applied futurist -- that is, someone who not only thinks about what is to come in the future but also acts and plans accordingly. To intelligently invest requires the belief that the future will be amenable to that in which one is invested, or at least to believe that the corporate management teams in which one has entrusted their money can adequately discern the future and allocate capital accordingly.

Here are some of the Big Picture trends on my mind:

Peak Population: The rapid slowdown in population growth in the United States and shift into outright population decline across much of the developed world.

AI-Driven Market: Whether it makes sense to see more and more capital flow into increasingly high-valuation, techy growth stocks in a world of low and falling economic growth.

Labor Market Mismatch: AI's negative impact on the white collar labor market and the growing labor shortage among blue collar professions.

Tariffs: The speed and degree to which tariffs will cause a general increase in prices, and the degree to which higher goods prices will be offset by lower prices and less spending on services.

The K-shaped Economy: The huge and growing bifurcation between the Affluent (top ~40% of earners), who account for the vast majority of consumption, and the Paycheck-to-Paycheck class (bottom ~60%), who live in an increasingly unaffordable economy.

Surging National Debt: How the mounting national debt is likely to weigh down economic growth going forward.

The Political Pendulum: Where the dissatisfied P2P population will swing the political pendulum next (e.g. Leftist populism, higher taxes, more government involvement in healthcare, more state control of the private market).

On that last point, my understanding is that the swing voters who aren't solidly on one side or another of the culture war base their voting decisions largely on economic issues -- that is, how satisfied they feel with their financial situation and prospects.

Rightly or wrongly, those dissatisfied with their financial situation tend to blame the party in power and put their hope in the alternative party to alleviate their plight. Then, four years later, with their plight still not alleviated, they again become disillusioned with the current party in power and swing back in the other direction.

My sense is that for the foreseeable future, the winds of US politics are going to shift from one ill-conceived populist solution to another.

To my mind, that most likely indicates a future of low economic growth and higher tax rates.

And my sense is that, just as it did in Japan, Europe, and China, this macro future will lead to persistently low inflation and interest rates in the United States as well.

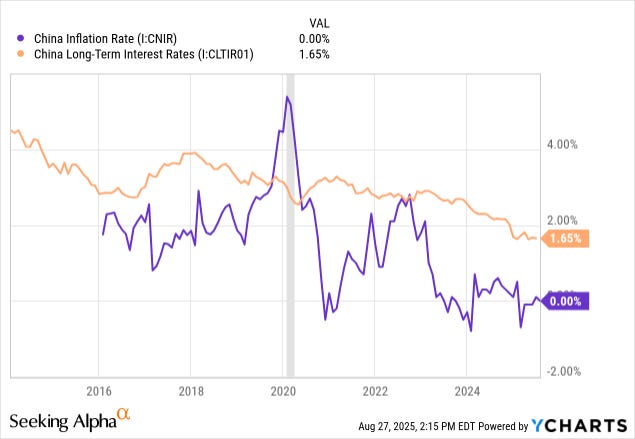

What was described as "Japanification" a decade ago then became "Eurofication" and then "Chinafication." China's population peaked in 2021 and has declined every year since. The inflation rate in China is currently 0.0%. Long-term interest rates are under 2%.

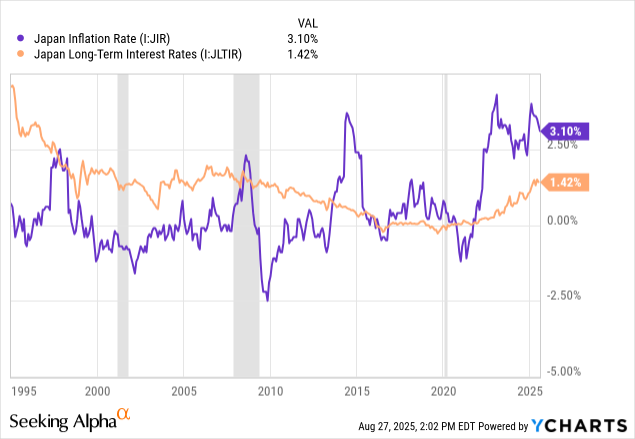

You might object that Japan is currently experiencing its highest level of inflation in decades, and long-term interest rates are rising as a result.

But looking back over the last three decades, it's worth noting that Japan has had a few spikes of inflation, which were followed by a return to ultra-low, flat, or slightly negative rates of inflation.

"Japanification" probably isn't dead. More likely, it is simply undergoing a longer-than-usual period of higher inflation and weakening yen, which is pushing up long-term interest rates from 0%.

But note that both inflation and long-term interest rates in Japan remain quite low. I don't think the current situation disproves the thesis that, all else being equal, population decline and low economic growth lead to low inflation and interest rates.

The US will be the last domino to fall in the developed world.

And when exactly that domino falls depends largely on net immigration.

An Amendment to "The Population Bomb, Defused"

One last note on this topic.

In our recent Market Update titled "The Population Bomb, Defused: The Underappreciated Impact of Peak Humans," we mentioned that we envision home values in average areas to stagnate or decline.

After studying the case of Japan further, there's an important nuance to add on this topic.

In Japan, where the population peaked in 2008 and has been declining ever since, economic opportunities in smaller towns and rural areas have become increasingly scarce, as many schools have closed and job opportunities have become extremely limited. That has pushed more and more young people into big cities, which has helped to maintain real estate values in those vibrant cities.

Despite a broader drop in the Japanese population, Tokyo's population has continued to grow.

The same, more or less, is happening in China, South Korea, and the parts of Europe where the population is already declining.

In these countries, well-located urban real estate has maintained value, while rural real estate values are collapsing. Some towns are basically giving away homes. Others are literally paying people to come live in them.

The cases of Japan and Tokyo indicate that, even decades after a country's population peaks, residential and commercial real estate continue to thrive in the most vibrant cities.

We REIT investors ought to keep that in mind going forward.

Portfolio Recycling in August

This month, I did a fair amount of portfolio recycling to lock in some gains as well as to open a few new positions.

Here's the summary: