What Austin Bought And Sold In January 2026

This is the next installment in our monthly series on the portfolio of our macro analyst, Austin Rogers. Please note that our main focus will remain on the HYL Portfolios, but since many of you have expressed interest in knowing how Austin manages his portfolio, we are posting this to give you extra value.

It has been a strong start to the year for a broad swathe of dividend stocks.

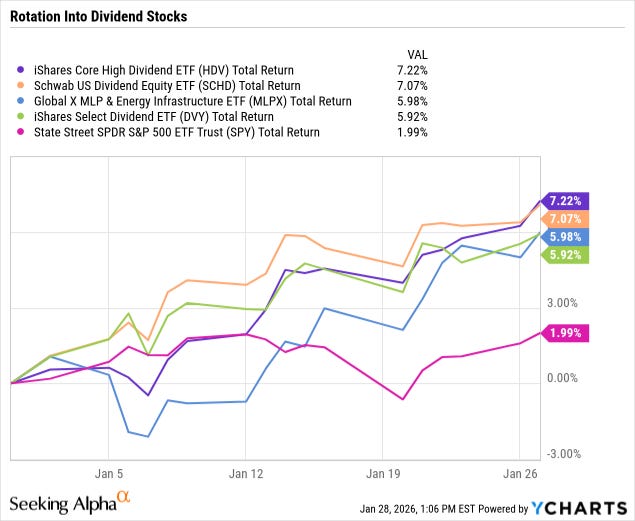

Here’s how a handful of moderate-yielding dividend growth ETFs performed relative to the S&P 500 (SPY) (pink line) in January:

The large-cap dividend payers in the iShares Core High Dividend ETF (HDV) and Schwab US Dividend Equity ETF (SCHD) have already returned 7%+, while midstream energy companies (MLPX) have collectively returned about 6%, and the predominantly small/mid-cap portfolio of the iShares Select Dividend ETF (DVY) have returned just under 6%.

Of course, that’s just one month of performance, but after a multi-year period of relentless momentum in AI-related stocks, it’s nice to see some early signs of a broad-based rally.

As I explored in “Roaring ‘20s: How I Learned To Stop Worrying And Love This Market,” I think multiple sectors outside of AI-tech should perform well this year as capital rotates in search of diversification and AI users begin to see benefits from the technology.

What about REITs?

So far this year, the real estate sector (VNQ) only briefly participated in the rally, only to be dragged back down by the spike in long-term interest rates.

With the 10-year Treasury rate hovering around 4.25% as of this writing, interest rates remain a headwind to the REIT rebound, for now.

But I think the 10-year Treasury rate is hovering around the high end of the range in which I think it will stay for the foreseeable future.

Based on estimated real GDP growth of about 2% in 2026 plus estimated year-end CPI of about 2%, we think nominal GDP growth will be about 4% a year from now. That would seem to justify a 10-year Treasury rate of about 4%.

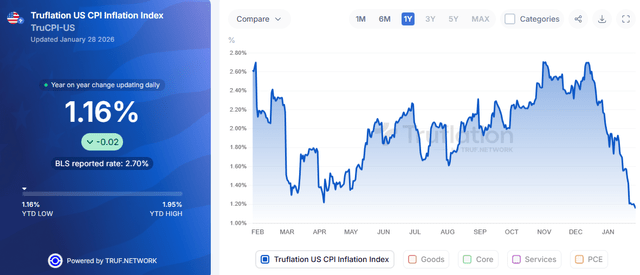

But given how much Truflation’s real-time inflation gauge has collapsed in recent months, I think even lower long-term interest rates would be justified.

Truflation

The correlation between REITs and long-term bonds is frustratingly mechanical, but fortunately, the fundamentals seem to support lower long-term interest rates, which would in turn give REITs a fundamental tailwind.

Top 10 Holdings

My top holdings list looks substantially the same as it did a month ago.

I was very happy to hear about Jussi’s trip to Michigan, during which he got to meet with Joey Agree at the Agree Realty (ADC) corporate office. You can read his interview with Joey Agree HERE.