What RPD Bought And Sold In December 2025

Quick Note from Jussi:

This article is a great example of how we don’t always agree on all our investment decisions, and we don’t try to hide those disagreements. Paul has decided to sell his position in Alexandria Real Estate (ARE), while I have bought the dip and plan to keep accumulating a larger position.

As Paul has previously said, mostly when we disagree, it fundamentally reflects differences in risk tolerance or timescale. Paul is retired and relies on safe dividend income. Jussi is willing to step into more speculative situations, like what Alexandria has become, in an attempt to earn large gains at the cost of greater risk.

We prefer to voice these disagreements rather than to hide them in order to give you different perspectives. While it can lead to confusion at times, it should also help you assess where you personally fit on these issues. At the end of the day, you have to hear arguments to make your own best judgments.

In what follows, Paul explains why he decided to take the loss and move on. You can also read Jussi’s perspective on Alexandria’s present challenges and long-term potential by clicking here.

What RPD Bought And Sold In December 2025

This month is an exception to my normal format. In late December, I sold all my Alexandria Real Estate (ARE) at a loss. After all my table pounding in favor of this stock, my action deserves a lengthy explanation.

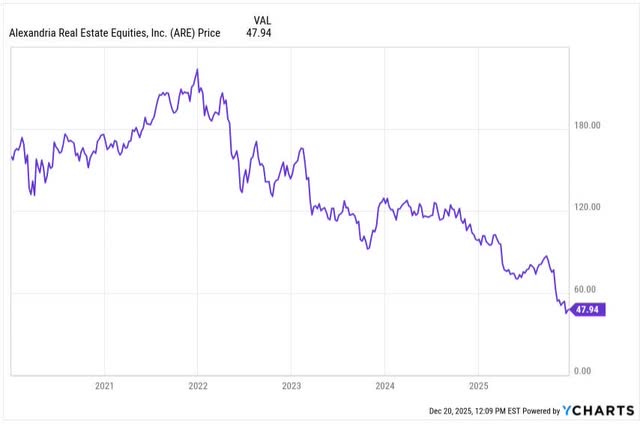

This was my biggest realized loss since the pandemic, as a fraction of the portfolio. Today’s article discusses that decision.

In combination, my Alexandria Real Estate (ARE) position was down by half in market value. And I did not start buying until late 2024, when it had already dropped in half from its high at the end of 2021. Nearly all of those (unrealized) losses happened in 2025:

I often reproduce the Buffett quote to the effect that one has to be comfortable seeing a stock drop 50% in price in order to invest successfully long-term. And I have done that before. So the price drop was not a worry.

But I decided last week to sell all my ARE, and I did that a few days ago. Here is the story.

The Bull Case

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.