TRADE ALERT - Retirement Portfolio January 2026

Dear Landlords,

I want to extend a warm welcome to all our new members!

As a reminder, our most recent “Portfolio Review“ was shared with the members of High Yield Landlord on January 5th, 2026. You can read it by clicking here.

You can also access our three portfolios on Google Sheets:

New members can start researching positions marked as Strong Buy and Buy while considering the corresponding risk ratings.

============================

TRADE ALERT - Retirement Portfolio January 2026

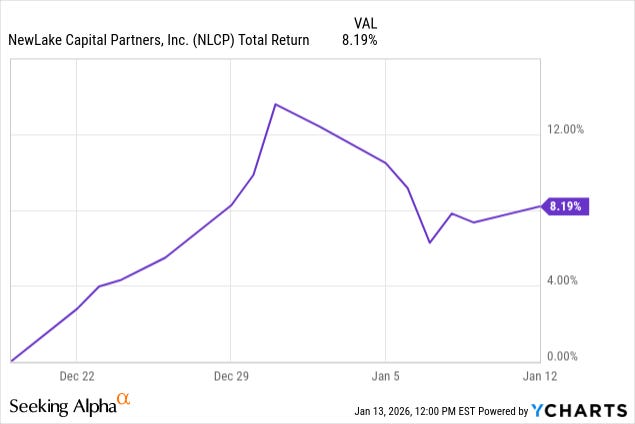

After President Trump signed an executive order initiating the process to reschedule cannabis as a less dangerous, Schedule III drug, we immediately bought more shares of Cannabis REIT NewLake Capital Partners (NLCP), predicting that its rally would likely continue as the market recognizes how positive this could be for its tenants.

So far, this has paid off as its stock has risen another 8% since then:

But oddly, NLCP’s close peer, Innovative Industrial Properties (IIPR) did not rise much at all. On the contrary, its Series A preferred stock (IIPR.PR.A) even dipped 7% since then.

As a result, it now trades at just $23, which is near its lowest share price ever. It now offers a 9.8% dividend yield and nearly 10% upside to par value.

We think that this is an exceptionally high yield for a company with so little leverage and strong dividend coverage.