Top Picks For 2026 - Honorable Mention #1

Over the past weeks, we have shared our Top 5 Picks for 2026. You can access each one by clicking the links below:

These companies provide some of the best risk-to-reward in today’s market. That said, there are many other compelling opportunities available, which prompted one of our members to make the following request:

Hello Jussi. I thought the Top 5 Series was one of the best things you have provided us. Each one of the Top 5 make sense to me. And I have acted upon your recommendations. Of course, diversification is important. With that in mind, would you be comfortable providing a few investments that you would call your HONORABLE MENTIONS?

That’s exactly what we will do.

We are adding 5 more companies to this list:

Top Picks For 2026 - Honorable Mention #1:

Carl Icahn is commonly seen as the “grandfather of activist investing”, regularly going after companies to push them to unlock value for shareholders by restructuring and selling assets.

The self-made billionaire has invested across nearly every sector, but where he has arguably had the most success in his 60+ year career has been in casinos.

In 1998, he bought the casino operations of the Stratosphere casino on the Las Vegas strip. He then reinvested in it to improve operations and sold it for $1 billion a decade later.

He also acquired a piece of the Tropicana casino when it went bankrupt in 2008, and again, he restructured operations, changed the leadership, and then sold it a decade later for $1.85 billion.

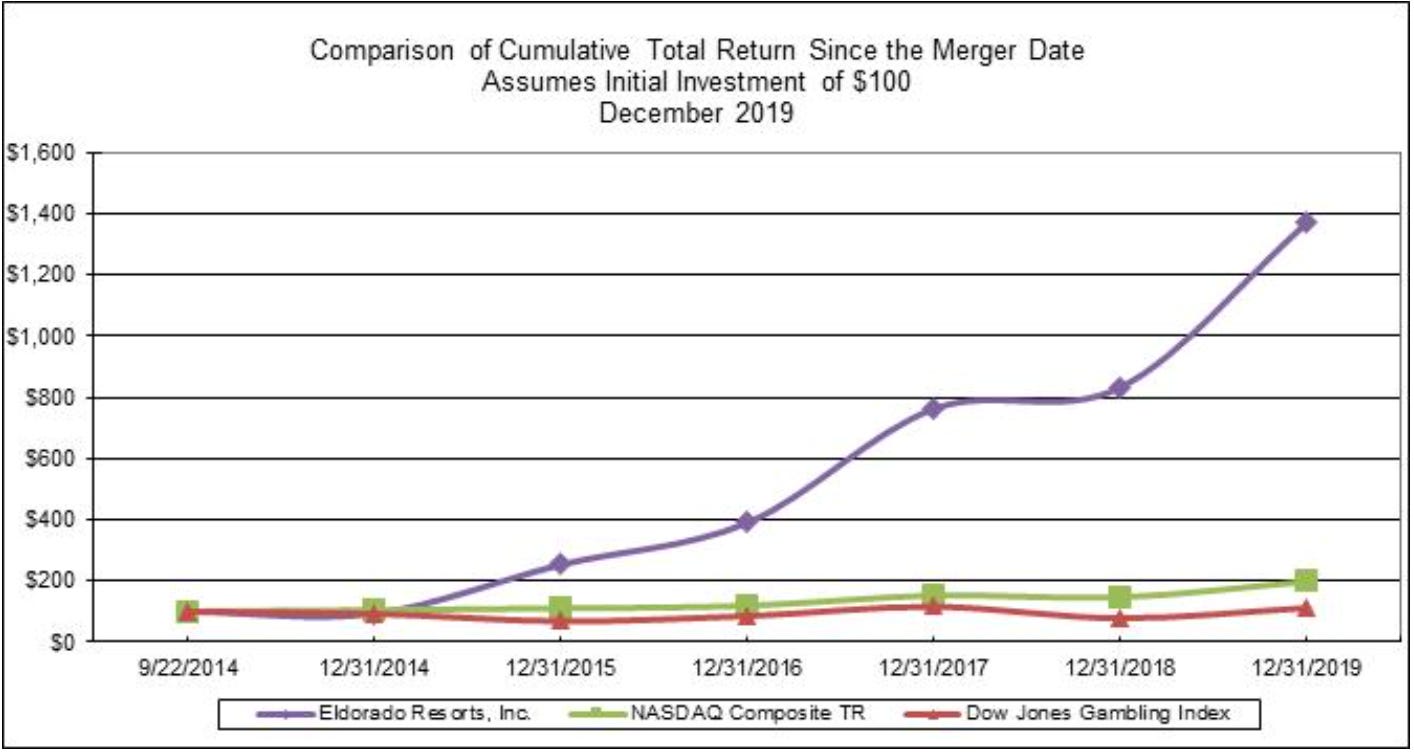

Then shortly after, he bought a large stake in Caesars in 2019, changed its leadership, and helped put together the Eldorado merger, walking away with an estimated $1.5 billion gain.

This is very interesting when you consider that he reinitiated a position in Caesars in the Summer of 2024 when its share price traded in the mid-30s. Back then, he amassed a sizable stake in the company and told CNBC that he liked the company and its management, and he would “never do activism at Caesars”. For context, Icahn knows Caesars’s current CEO, Tom Reeg, from the time when he pushed for Caesars to merge with Eldorado. Reeg was then the CEO of Eldorado, and here is his track record leading the company: